5 Car Insurance Add-Ons That Could Save Your Tail.

Here in Nova Scotia, there is a provincial law that every car on the road must have a minimum amount of insurance coverage. However, there are a number of add-ons…. we insurance pros call them “endorsements”…. that provide extra coverage and can end up save you some serious dough in the long run.

The five add-ons listed below are often inexpensive and are definitely worth the money if you’re eligible for them. Check it out:

Accident Forgiveness / Claims Forgiveness.

This endorsement protects you from insurance rate increases if you get into an at-fault car accident. Usually, a car accident would lower your insurance rating and cause your premium to go up (sometimes by hundreds of dollars per year!). If you have added this endorsement to your policy, your insurance company will “forgive” your first at-fault accident and will not charge you a higher premium because of the accident when your policy renews with them.

Minor Conviction Protection.

This endorsement protects you from insurance rate increases in the event of a minor driving infraction or, in insurance lingo, a “conviction”. Minor driving convictions include, but are not limited to, speeding, failure to wear a seat belt, improper turning, failure to signal, and headlight offenses. Many Nova Scotians think that only major traffic violations that cause license demerit points impact their insurance premium, but minor traffic violations such as the ones listed above can lead to rate increases as well. If you have added this endorsement to your policy, your insurance company will “forgive” your first minor conviction and will not charge you a higher premium because of the conviction when your policy renews with them.

Limited Waiver of Depreciation.

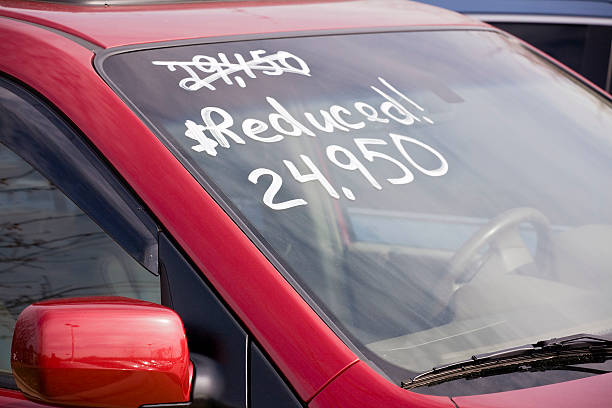

If you purchase or lease a brand new car, this particular endorsement will limit the depreciation charged on your car for the first 24-36 months of ownership, depending on the insurance company. In other words, if your car is stolen or written off in an accident, you will receive what you paid for the car in your claim settlement, instead of the actual cash value of the car. For example, if you purchase a new car for $35,000 then the car is written off the following year in an accident, this endorsement would ensure that you receive $35,000 (or a vehicle of equivalent value) in your claim settlement. Without this endorsement, you would only receive the “actual cash value” of the car. Since car value decreases a lot in the first year, you may only receive $20,000 or $25,000. Statistics show the value of a new car goes down by ~ 9% when you drive it off the lot (ouch!), so this endorsement is definitely worth attaching to your policy, especially if you are leasing or financing your car.

Loss of Use.

This endorsement, also known as the “SEF 20” in insurance lingo, covers your transportation costs if your car is stolen or damaged in an accident. Costs such as renting a car or taking a bus or taxi back and forth from work will be covered up to the maximum amount specified in your policy until your car is repaired or replaced.

Legal Liability for Damage to Non-Owned Vehicles.

This endorsement, also known as the “SEF 27” to those of us in the insurance industry , covers any damage you may cause to a car you don’t own while it’s under your care and control, like a rental car. If you travel a lot or rent cars often, this endorsement is definitely worth looking into.

Although they may slightly increase your monthly insurance payment, these five endorsements could end up saving you a lot of money in the long run. Not everyone is eligible for these endorsements, but call us to see if you qualify! The Cheep Insurance team is happy to answer any of the questions you may have about the add-ons described above or anything else related to your insurance coverage.

If you want us to shop your policy for you and price out the above options, we’re happy to do that that too. We have the largest selection of insurance companies in Atlantic Canada, so we can find you the best price available for your unique insurance needs.

Get in touch today at (902) 463-1675 or [email protected] for your free quote!

Most policies insured with Cheep Insurance are Agency Bill/IFS financed policies. You can determine who manages your payments by following the directions below. If you are still not sure who manages your payments, call our team as funds paid directly to the insurance company when they should go to IFS will cause large delays.

Most policies insured with Cheep Insurance are Agency Bill/IFS financed policies. You can determine who manages your payments by following the directions below. If you are still not sure who manages your payments, call our team as funds paid directly to the insurance company when they should go to IFS will cause large delays.